Employers struggling with the steady rise of health insurance costs which in 2009 increased 5 percent to an average of $13,375 for family coverage — are passing on more of the expense to their workers through higher deductibles and co-payments, according to survey released today.

The average deductible for an individual in a preferred provider organization, the most common type of health plan, rose to $634 this year from $560 last year, the survey by the Kaiser Family Foundation and the Health Research & Educational Trust found.

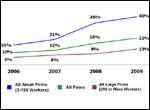

At firms with fewer than 200 workers, about 40 percent of workers have at least a $1,000 deductible this year, twice the level from two years ago, according to the survey, which was completed by 2,054 public and private employers with three or more employees.

The 5 percent increase in employer-sponsored health insurance costs for family coverage is less than the double-digit growth in premiums earlier this decade but was sharply higher than overall inflation, which dropped 0.7 percent this year, mostly due to declining energy prices.

The survey was conducted between January and May of 2009.

“When health care costs continue to rise so much faster than overall inflation in a bad recession, workers and employers really feel the pain,” said Drew Altman, president and chief executive officer of the Kaiser Family Foundation. “That’s why we are having a health reform debate.” (KHN is part of the foundation.)

Since 1999, health insurance premiums have soared 131 percent — more than triple the rise in workers’ wages and four times the overall inflation rate, the report said.

Paul Fronstin, senior research associate at the Employee Benefit Research Institute, said that “employers see raising deductibles as the easiest way to control costs.” The higher deductibles are one reason why premiums have been going up more slowly in recent years. “It’s a crude instrument, but it does the job,” he said.

Last month, Underground Archives Inc., a document and videotape storage company in Wampum, Pa., near Pittsburgh, added a $1,200 deductible to the insurance plan for its 42 employees.

“It was difficult, but it was one of the things we needed to do as our annual premium was going up 40 percent,” said Tom Roth, the company’s vice president. By adding the deductible and raising co-pays for doctor visits to $25 from $10, the company was able to keep its premium flat, he said.

Despite his wariness of government solutions, he’s hoping Congress takes action to overhaul the health system and hold costs in check. “With government it could always get worse, but things are definitely out of control and something needs to happen,” Roth said.

‘We’ve been hammered on every front’

While the percent of firms offering health coverage remained steady at 60 percent, one in five employers said they had reduced their scope of benefits or increased employee cost sharing during the economic downturn, the survey found.

Nationally, the average doctor visit co-payment this year is $20 for a primary care doctor and $28 for a specialist, the survey found. Those figures have been rising slowly but steadily for the past few years.

Amanda Austin, director of federal public policy at the National Federation of Independent Business, said most small businesses “see no end in sight, frankly,” to premium increases. “Health insurance premiums are one of the most unpredictable costs in your budget line,” she said.

Bruce Josten, executive vice president for Government Affairs with the U.S. Chamber of Commerce, said he expects increases in health insurance rates to remain steady next year because any changes that might occur as a result of a health overhaul could take several years to be implemented.

He said that if Congress requires most people to buy insurance, it could stabilize or lower costs by compelling younger and healthier people to participate in the overall insurance pool, spreading the risk. “They need to be insured and stop the shifting of that cost of uncompensated care back to everybody else in the system that is a payer,” he said.

As part of the health care debate, President Barack Obama and congressional Democrats have repeatedly said that Americans who like their insurance can keep what they have. But the survey points out that the cost of insurance is getting more expensive for employees because of actions by their employers to stem rising costs.

While workers’ share of the health insurance premium has remained steady, employees are paying a higher premium as the overall insurance cost has increased. Workers are paying $779 for single coverage in 2009, compared to $318 in 1999. They’re paying $3,515 for family coverage compared to $1,543 a decade ago.

At Geonerco Management, a real estate developer in Seattle that has reduced its workforce by 70 percent since 2008, most of the 41 employees are enrolled in a health plan that has an annual deductible of $1,500 and a health savings account. The tax-deferred account allows employees to put aside money for certain health expenses. Nationally, about 8 percent of Americans are enrolled in such plans which were first sold in 2003.

Greg Szymansi, director of human resources at Geonerco, said the high-deductible plan was the only way to control costs without reducing benefits or making employees pay a significantly higher premium. “We’ve been hammered on every front,” he said, referring to the company’s business during the economic downturn. “Our goal was to hold premiums flat and try to keep our health insurance costs under control.”